CSR Services for Companies Applicable Under the Companies Act, 2013

Have Queries? Talk to CECL Experts

Have Queries? Talk to CECL Experts

Companies have assumed a major role in the society, business has duty to serve society in general as well as the financial interests of stockholders. Corporate Social Responsibility (CSR) is a tool to integrate economic, environmental and social objectives with the Company’s operations and growth.

Companies contribute to sustainable development by managing their operations in such a way as to enhance economic growth and increase competitiveness whilst ensuring environmental protection and promoting social responsibility, including consumer interests.

CSR is a mandatory provision under Companies Act, 2013; an initiative of the Government to engage businesses with the agenda of national development. CSR is an instrument through which Companies contribute towards the economic development while improving the quality of workforce, their families, local community as well as society at large.

Governing Laws:

Section 135 of Companies Act, 2013;

Section 135 of Companies Act, 2013; CSR Rules 2014;

CSR Rules 2014; Schedule VII of Companies Act, 2013;

Schedule VII of Companies Act, 2013; The CSR (Amendment) Rules, 2021 and the Companies (Amendment) Act, 2020.

The CSR (Amendment) Rules, 2021 and the Companies (Amendment) Act, 2020.Applicability:

Companies falling under CSR preview: - As per Section 135 (1) of Companies Act, 2013

-Every Company (including Foreign Company) having: -

Net worth of Rs. 500 Cr. or more Or;

Net worth of Rs. 500 Cr. or more Or; Turnover of Rs. 1000 Cr. or more Or;

Turnover of Rs. 1000 Cr. or more Or; Net Profit of Rs. 5 Cr. or more

Net Profit of Rs. 5 Cr. or more-During immediately preceding Financial year

The Companies to whom CSR is applicable needs to constitute CSR Committee (However, CSR Committee is not required, if amount to be spent by a company does not exceed fifty lakh rupees. In such cases Board shall discharge all functions of CSR Committee.

Note: Company which does not satisfy the above-mentioned criteria for a consecutive period of three financial years is not required to comply with the CSR obligations.

It is implied that a Company not satisfying any of the above specified criteria in a subsequent financial year would still need to undertake CSR activities unless it ceases to satisfy the above- mentioned criteria for a continuous period of three years.

Definition of CSR:

- Rule 2 of CSR Rules, 2014 [Amended by the Companies (Corporate Social Responsibility Policy) Amendment Rules, 2021]

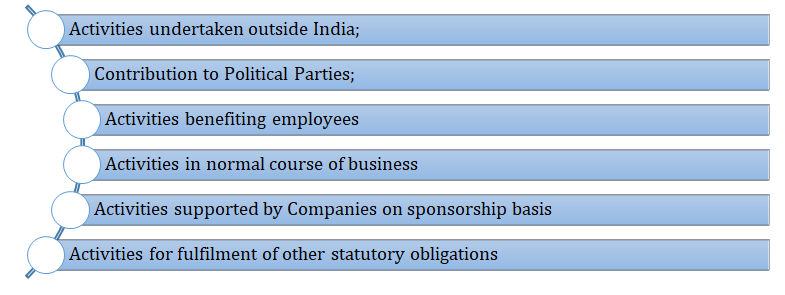

- Rule 2 of CSR Rules, 2014 [Amended by the Companies (Corporate Social Responsibility Policy) Amendment Rules, 2021] - Activities not considered as CSR specified clearly. Accordingly, the following activities shall not be considered CSR:

- Activities not considered as CSR specified clearly. Accordingly, the following activities shall not be considered CSR:

CSR Expenditure:

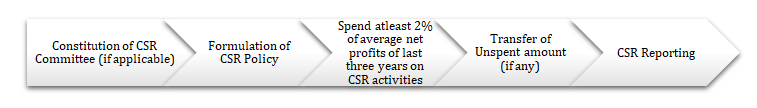

The Board has to ensure that the company spends in every financial year at least 2% of the average net profits of the company made during the three immediately preceding financial years or where the company has not completed the period of three financial years since its incorporation, during such immediately preceding financial years, on Corporate Social Responsibility in accordance with Activities specified in Schedule VII in pursuance of its policy in this regard;

Documents required from Company for CSR Reporting/ Implementation and Guidance:

Audited Financial Statements of the entity for preceding three financial years;

Audited Financial Statements of the entity for preceding three financial years; CSR Policy;

CSR Policy; Details of CSR Projects already undertaken by the Company;

Details of CSR Projects already undertaken by the Company; Details of activities carried on by the Company in the earlier years;

Details of activities carried on by the Company in the earlier years; CSR Report for preceding Financial Years;

CSR Report for preceding Financial Years; Details of unspent amount;

Details of unspent amount; Details of Computation of Net Profit for preceding three Financial Years; and

Details of Computation of Net Profit for preceding three Financial Years; and Details of Implementing Agencies.

Details of Implementing Agencies.

Composition:

Three or more Directors, including Atleast one Independent Director (if appointment of Independent Director is applicable on Company);

Three or more Directors, including Atleast one Independent Director (if appointment of Independent Director is applicable on Company); Where a private company has only two directors on the Board, the CSR Committee can be constituted with these two directors.

Where a private company has only two directors on the Board, the CSR Committee can be constituted with these two directors.Functions:

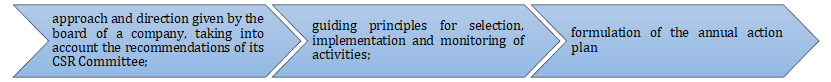

Formulate and recommend Board CSR Policy listing activities to be undertaken by the Company in areas or subject specified in Schedule VII of Companies Act, 2013;

Formulate and recommend Board CSR Policy listing activities to be undertaken by the Company in areas or subject specified in Schedule VII of Companies Act, 2013; Recommend expenditure to be incurred on activities undertaken in accordance with CSR policy;

Recommend expenditure to be incurred on activities undertaken in accordance with CSR policy; Monitoring CSR policy from time to time;

Monitoring CSR policy from time to time; Formulate and recommend Board Annual Action Plan in pursuance of its CSR Policy.

Formulate and recommend Board Annual Action Plan in pursuance of its CSR Policy.CSR Policy to include:

Quantum of Expenditure:

at least two per cent. of the average net profits of the company made during the three immediately preceding financial years or where the company has not completed the period of three financial years since its incorporation;

at least two per cent. of the average net profits of the company made during the three immediately preceding financial years or where the company has not completed the period of three financial years since its incorporation; - “net profit” shall not include such sums as may be prescribed, and shall be calculated in accordance with the provisions of section 198.

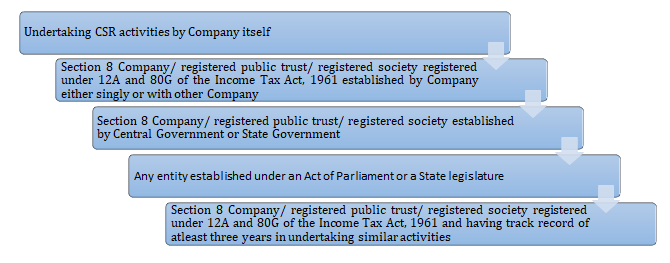

- “net profit” shall not include such sums as may be prescribed, and shall be calculated in accordance with the provisions of section 198.Implementation of CSR projects can be undertaken through:

Every eligible entity who intends to undertake any CSR activity, shall register itself with the Central Government by filing the Form CSR-1 electronically with the Registrar of Companies.

Expenses incurred by the company for ‘general management and administration’ of Corporate Social Responsibility functions only are classified as Administrative overheads.

Expenses incurred by the company for ‘general management and administration’ of Corporate Social Responsibility functions only are classified as Administrative overheads. The expenses incurred for the designing, implementation, monitoring, and evaluation of a particular Corporate Social Responsibility project or programme directly are specifically excluded.

The expenses incurred for the designing, implementation, monitoring, and evaluation of a particular Corporate Social Responsibility project or programme directly are specifically excluded. The administrative overheads shall be limited to 5% of total CSR expenditure of the company for the financial year.

The administrative overheads shall be limited to 5% of total CSR expenditure of the company for the financial year.If the Unspent amount relates to ongoing project:

Such unspent amount must be transferred to “Unspent CSR Account for the relevant Financial Year” within 30 days from the end of Financial Year.

If the Unspent amount does not relate to ongoing project:

Such unspent amount must be transferred to Funds specified in Schedule VII within 6 months from the end of Financial Year

Annual Report on CSR: (Rule 8 of CSR Rules, 2014) [Amended by the Companies (Corporate Social Responsibility Policy) Amendment Rules, 2021]

Annual Report on CSR in the prescribed format, is mandatory required to be included in Board’s report. The report containing the details of CSR Activities undertaken by the company and contents of CSR policy shall be made available on Company’s website.

From financial year starting on or after 01/04/2020 CSR report shall be in Annexure – II; Annexure II mandates additional disclosures regarding:

Impact assessment

Impact assessment Amount available for Set-off

Amount available for Set-off CSR amount spent against ongoing project/not an ongoing project

CSR amount spent against ongoing project/not an ongoing project Administrative overhead

Administrative overhead Unspent amount against ongoing project/not an ongoing project

Unspent amount against ongoing project/not an ongoing project Details regarding capital assets

Details regarding capital assetsImpact Assessment for big CSR projects: Rule 8(3)(a) of the Companies (Corporate Social Responsibility Policy) Rules, 2014;

Companies with average CSR obligation of Rs.10,00,00,000/- (Rupees Ten Crores) or more in immediately preceding three financial years shall undertake impact assessment through an independent agency of their projects having outlays of Rs.1,00,00,000/- (Rupees One Crore) or more which have been completed not less than 1 year before undertaking the impact study;

Companies with average CSR obligation of Rs.10,00,00,000/- (Rupees Ten Crores) or more in immediately preceding three financial years shall undertake impact assessment through an independent agency of their projects having outlays of Rs.1,00,00,000/- (Rupees One Crore) or more which have been completed not less than 1 year before undertaking the impact study; The impact assessment reports shall be placed before the Board for approval and shall be annexed to the annual report on CSR;

The impact assessment reports shall be placed before the Board for approval and shall be annexed to the annual report on CSR; A Company undertaking impact assessment may book the expenditure towards Corporate Social Responsibility for that Financial Year, which shall not exceed 5% of CSR Expenditure for that Financial Year or Rupees Fifty Lakhs, whichever is less.

A Company undertaking impact assessment may book the expenditure towards Corporate Social Responsibility for that Financial Year, which shall not exceed 5% of CSR Expenditure for that Financial Year or Rupees Fifty Lakhs, whichever is less.Website Disclosure: (Rule 9 of the CSR Rules, 2014) [Amended by the Companies (Corporate Social Responsibility Policy) Amendment Rules, 2021]

The Board of Directors of the Company shall ensure essential disclosure of the following on the website of the Company:

1. The composition of the CSR Committee;

1. The composition of the CSR Committee; 2. CSR Policy and Projects approved by the Board.

2. CSR Policy and Projects approved by the Board.Every company to which CSR is applicable shall furnish a report on Corporate Social Responsibility in Form CSR-2 to the Registrar for the preceding year (2020-2021) and onwards as an addendum to form AOC-4/ AOC-4 NBFC (Ind AS)/AOC-4 (XBRl)/as the case may be.

1. Statutory Obligation

1. Statutory Obligation 2. Corporate Governance

2. Corporate Governance 3. Ethical Business Practices

3. Ethical Business Practices 4. Maintains Good Stakeholder Relationship

4. Maintains Good Stakeholder Relationship 5. Alignment of Economic and Social Responsibilities

5. Alignment of Economic and Social ResponsibilitiesThe benefits of CSR include the following:

Growth of Society as well as the Organisation;

Growth of Society as well as the Organisation; Positive Business Reputation;

Positive Business Reputation; Brand Recognition;

Brand Recognition; Increased Sales and Consumer Loyalty;

Increased Sales and Consumer Loyalty; Increased Profits and Better Financial Performance;

Increased Profits and Better Financial Performance; Benefits in attracting more funds;

Benefits in attracting more funds; Enhanced Public image;

Enhanced Public image; Fosters Sustainable Environment;

Fosters Sustainable Environment; Promotes Welfare and Healthcare;

Promotes Welfare and Healthcare; Builds Public Trust;

Builds Public Trust; Boosts the Company’s competitiveness;

Boosts the Company’s competitiveness; Increase in Employee Engagement and Retention rates, etc.

Increase in Employee Engagement and Retention rates, etc.The top CSR Companies of India includes the follows: Infosys, Tata Group, Wipro, Mahindra & Mahindra, Reliance Industries, HUL, ITC Limited, Vedanta, and many more.

CSR is a tool that helps the Organization as well as the Community in which an Organization operates to grow. Implementation of CSR requires a strategic approach, Expert advice and there are various technical aspects involved in it. Recently, Ministry has introduced various amendments to CSR Rules and have widen the scope of CSR Compliances and Reporting. Compliance Ease LLP has a team of Professionals that not only helps in Formulation of CSR Policy but also helps in implementation of CSR Projects that reaps best benefits to Community as well as the Organization. Our team helps you in framing CSR Strategy – by studying the needs of Community, Selection of Implementing Agency – Identify and recommend NGO for implementing CSR Strategy, carry out Due- Diligence, Project Management- Regular Monitoring and Evaluation, Impact Assessment and helps to relief the Compliance Burden of the Company by complying with the requirements of Companies Act, 2013 and any other prevailing regulation. You can connect with us at info@complianceease.in or connect at 9773646999.